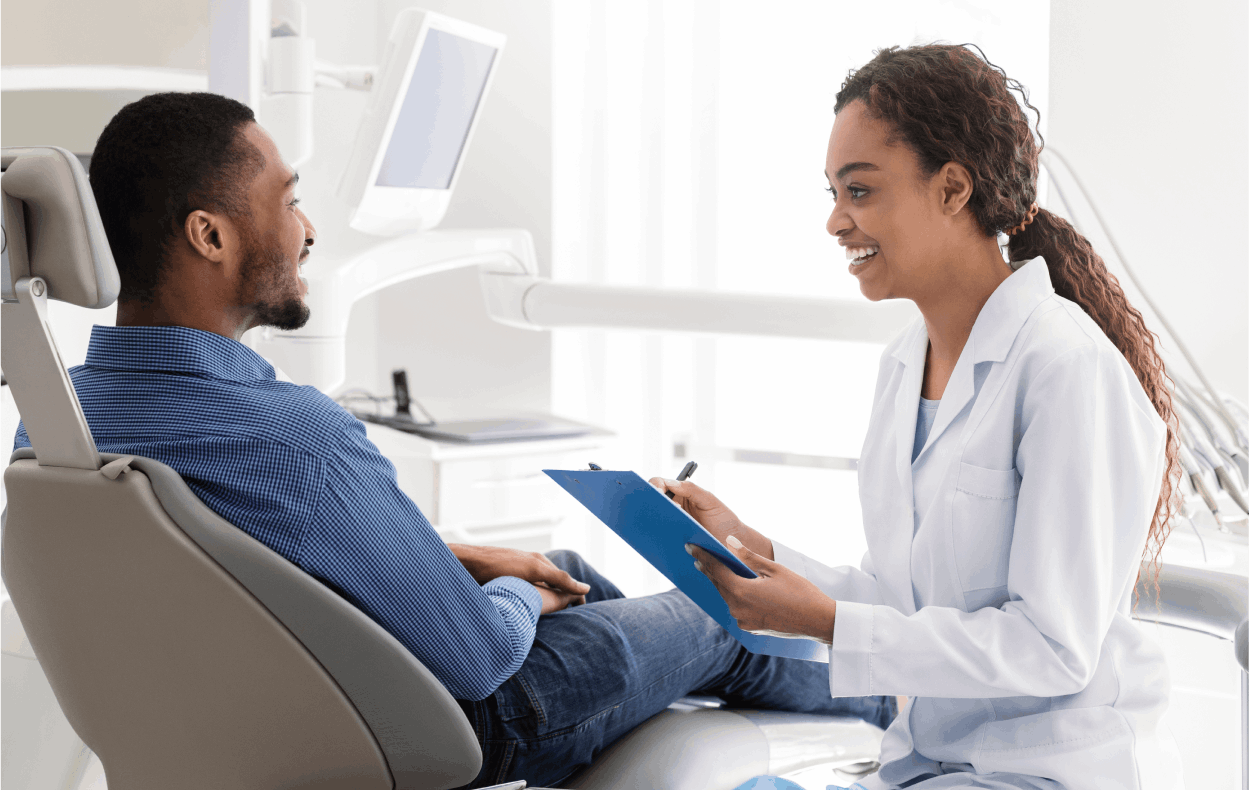

Tailored to your business' needs

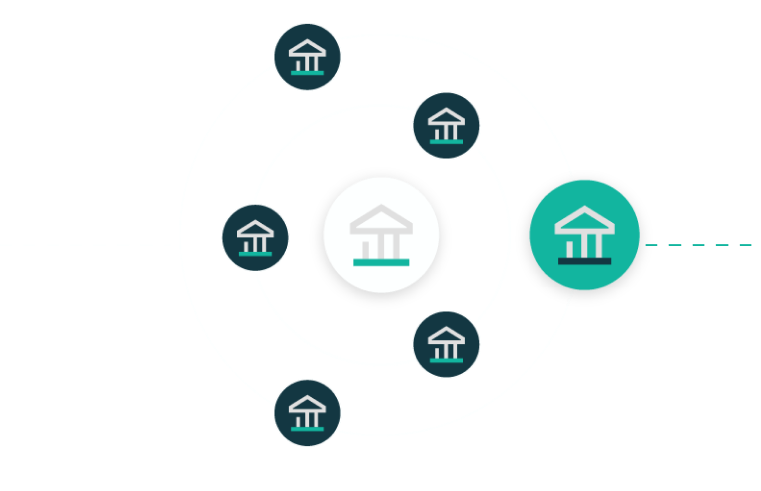

The multi-lender way

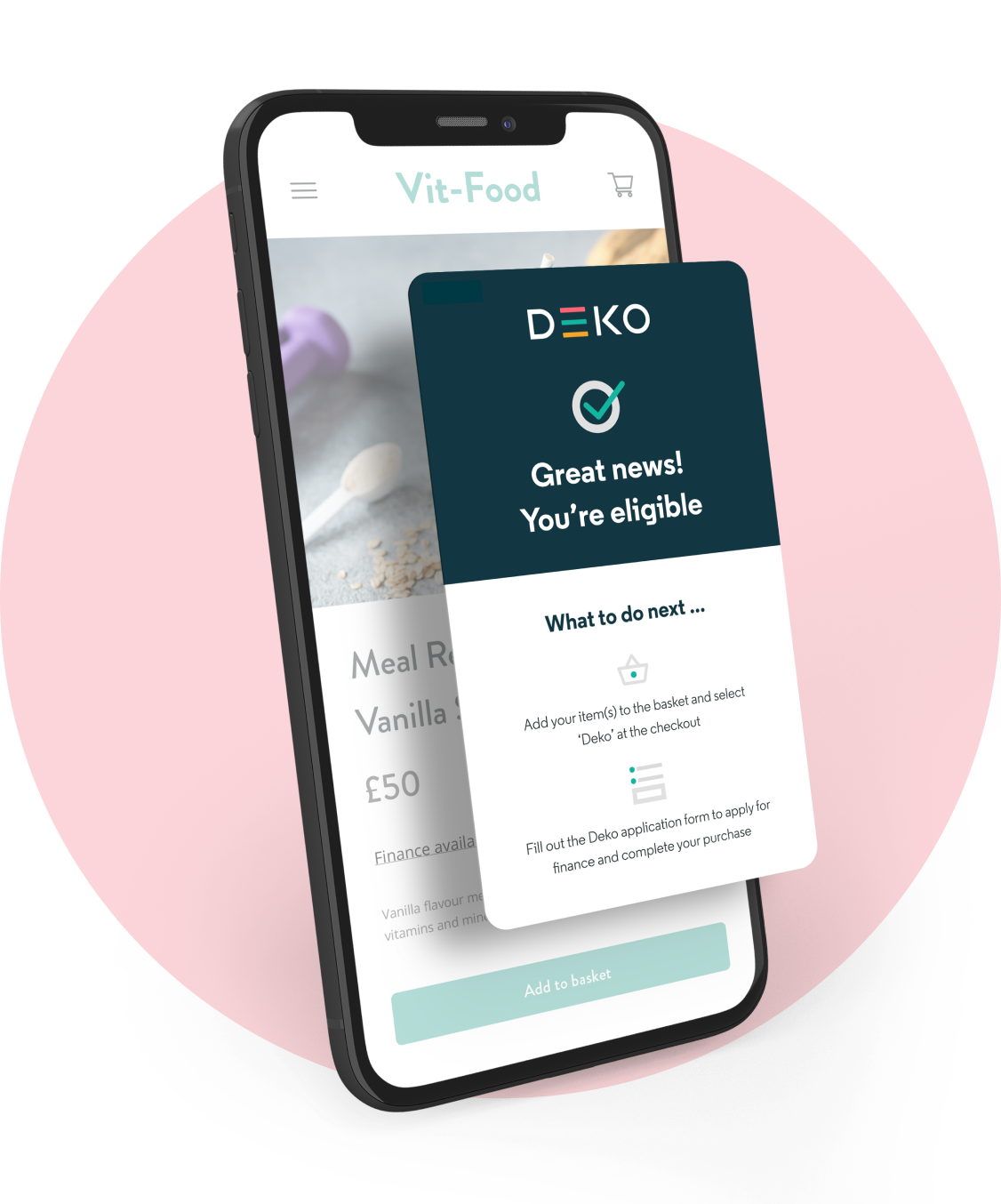

Unlike traditional pay later providers, our solutions are connected to a panel of lenders with a range of credit appetite. This means we can increase acceptance rates so more of your customers can access the treatment and products they need for a healthier and better life.

.png?width=1249&height=790&name=protein%20final%20(1).png)

.png?width=1081&height=1027&name=Group%20846%20(4).png)